Shark Tank India Season 2 Episode 51

Shark Tank India Season 2 Episode 51 aired on 13th March 2023 on Sony Entertainment Television. In this episode there are 4 Startups have Pitches their pitch Infront of Sharks. In this episode the Judges are 1) Namita Thapar : Executive Director (Emcure Pharmaceuticals), 2) Vineeta Singh : Co-Founder & CEO (Sugar Cosmetics), 3) Amit Jain : Co-Founder & CEO (CarDekho Group), 4) Vikas D Nahar : Founder & CEO (Happilo), 5) Aman Gupta : Co-Founder & CMO (boAt)

Table of Contents

Go Desi

Shark Tank India Season 2 Episode 51 Pitch No. 1 : Go Desi has presented their Idea and ask 90 Lakhs for 0.5% Equity for More details kindly read full Article below.

Co-Founder : Vinay Kothari & Raksha Kothari Vinay Kothari - CEO Raksha Kothari - Co-Founder & Sourcing Head Website - https://godesi.in/ Products - DESi POPz , DESi Meetha , DESi Bytes , DESi Mints , BYO Popz Box , DESi Gifts , DESi Combo Self Life of Products - 12 Months Commission -(20% Retailer), (10%-15%- Distributor & Super Stockist ) on MRP Competitor - Regional Player not any organized firm Ask - ₹90 Lakhs for 0.5% Equity at Valuation ₹180 Crores

Pitch of Go DESi

Raksha Kothari : Sharks Do you feel like eating something sour and sweet? The taste of eating raw mango dipped in black salt is something else and that sour sweet tamarind !

Vinay Kothari : Sharks We natives like spicy very much. If you look at the history of package food, many foreign companies came which brought with them many different products like Biscuits, Chocolates, Chewing gum, Energy Bars, Breakfast Cereals or even Noodles, but thousands of unique products of our country got lost in these, but not now because we have brought the Go Desi

Ask By Go Desi in Shark Tank India ₹90 lakhs for 0.5% Equity at Valuation- ₹180 Crores

Background of Vinay Kothari and Raksha Kothari

Both the co-founder are Brother and Sister

Vinay Kothari : Educational Background He has Completed B. Com form Bangalore University. MBA in Marketing from Symbiosis Centre For Management and Human Resource Development. Working Background Retail Sales and Operations Manager - May-2007 to Mar 2009 (ITC Limited) State Manager- Madhya Pradesh(Bhopal) April 2009 to Jun 2010 (ITC Limited) Assistant Branch Manager - Bihar And Jharkhand - May 210 To May 2011 (ITC Limited) Assistant Branch Manager - Ahemdabad (Gujrat) - May 2011 To May 2012(ITC Limited) Brand Manager Sunfeast - Bangalore - June 2012 To Dec 2014 Head Of Marketing - MadRat Games - Jan 2015 to Sep 2015

Raksha Kothari : Educational Background Bachelor of Engineering - BE, Chemical Engineering - RV College Of Engineering Diploma in Movement Arts -Attakkalari Centre for Movement Arts Bachelor of Technology - RV College Of Engineering Working Background Analyst - KPMG India - June 2010 to Jan 2014 Worked with many NGOs

How did you get this business idea ?

I had gone hiking in the Western ghats. When I Completed the Hike, I ate a jackfruit bar at the tea stall below. I found it delicious and I wondered why such products weren’t available in Bengaluru.

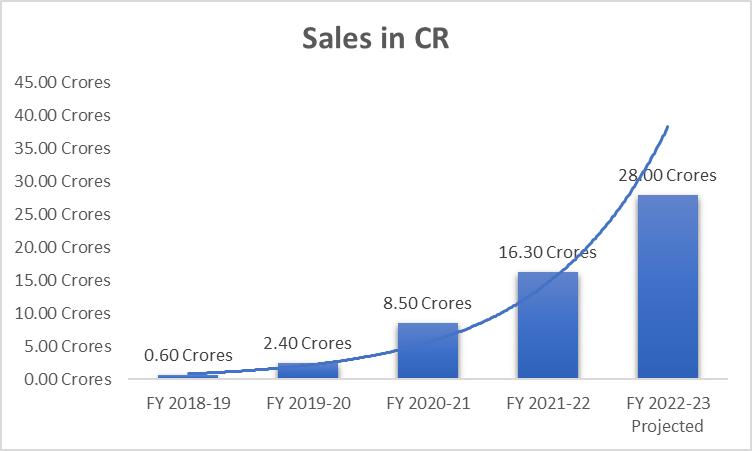

Sales

Annual Sales FY 2018-19 - ₹60 Lakhs FY 2019-20 - ₹2.40 Cr FY 2020-21 - ₹8.50 Cr FY 2021-22 - ₹16.30 Cr FY 2022-23 Projected - ₹28 CR

Previous Investment and Equity Split Before Shark Tank

Last Round, Investment & Valuation June 2022 - ₹31 Crores at the Valuation of ₹120 Crores

EBITA burn - 15%

Manufacturing

They have own Manufacturing units in a Small Village- Manangi, Sira, 130 KM far from Bengaluru they have employed almost 250 women in these Units. Production Capacity is 3 Lakh pops per day

Offer Given by Sharks

Veneeta's Offer - ₹60 Lakhs for 1% Equity & ₹30 Lakhs Debt @12% Interest at Valuation - ₹60 Crores. After this offer Vikash D Nahar Joined this offer with Veneeta and Amit Jain also want to join Veneeta offer with Vikash. Final offer by 3 Sharks - ₹90 Lakhs for 1.5% Equity without Debt at the valuation of ₹60 Crores Deal is Not Accepted by the Entrepreneurs

Original Ask ₹90 Lakhs for 0.5% Equity at Valuation ₹180 Crores

Word used in Shark Tank India

Cottage Industry : It is a small manufacturing operation and is often run out of a home by a single individual or family Working Capital - It is the capital required by a business to meet its day-to-day expenses CapEx - Capital Expenses EBITA- Anti-Dilution Clause : It Allows the investors to maintain their ownership percentages in the event that new shares ae issued

Also Read : PatilKaki: The Pune-Based Snack Brand

Also Read : Hornback X1 Price, Review

T. A. C.

Shark Tank India Season 2 Episode 51 Pitch No. 2 TAC is a new age Ayurveda brand where ayurveda products are manicured for youth like Kumkumadi, Eladi, Triphala & Bhringraj all the products are Certified from Ministry of Ayush Govt. of India and Clinically Tested.

Co-Founder : Param Bhargava & Shreedha Singh Website : https://theayurvedaco.com/ Launched : June 2021 Industry - Ayurveda Category - Skin, Hair, Baby, Sexual Wellness Brand Ambassador - Kajal Aggarwal Ask - ₹1.5 Crores for 0.5% Equity at Valuation ₹300 Crores

Pitch of TAC

Param Bhargava : “Sharks, The ayurvedic market in India is divided into two parts. On the one hand is the many mass-market brands that offer no guarantee of quality or results. And on the other hand is premium and luxury brands that the common man can’t afford for regular usage. For this reason ayurveda has failed to go mainstream. Ayurveda will not grow until people between 18 to 35 years do not buy it. It has to be made young, Sexy and Sassy.” To Solve these problems and to connect the youth with ayurveda, we gave it a big makeover. and we have launched TAC The Ayurveda co.

Available Across

Online : Own Website & Amazon Flipkart Etc. Offline : 2500+ Stores & 20 Exclusive Business Outlets Costomers : ₹10 Lakhs+ Customer Connected with this Company Products Solde : ₹20 Lakhs+ Products sold to these customers

Ask By TAC in Shark Tank India ₹1.5 Crores for 0.5% Equity at Valuation - ₹300 Crores

Sharks has asked that Ayurveda is old people's choice how are you attracting the Youth to your brand and products Marketing Strategies Social Media : They Campaigning ads which is suitable for youth and communicating in their language Influencer Marketing : Marketing by the people who are youth Icons. Activation : Visiting Campuses where people between the ages 18 to 22 are present in large numbers.

Background of Param Bhargava & Shreedha Singh

Both the Co-Founders are Husband & Wife

Param Bhargava : Education : HSE, Mathematics and Computer Science - Ramjas School - India, 1990 - 2005 BE, Mechanical Engineering - Rajasthan Technical University, 2005 - 2009 Working Experience : Key Account Manager - Atlas Copco, June 2009 to Jan 2012 Area Manager - Metso, Jan 2012 to May 2014 Regional Sales Manager - VE Commercial Vehicles Ltd., June 2014 to March 2018 Founder - KHADI ESSENTIALS, Apr 2019 to Present Founder - T.A.C - The Ayurveda Co., May 2021 - Present

Shreedha Singh : Education : MBA in HR - University of Business School, Chandigarh, 2012-2014 Working Experience : HR, Business Partner, International Business Sales/Marketing -VE Commercial Vehicles Limited, June 2014 to Feb 2017 Business Partner - BOMBARDIER Mar 2017 to Mar 2019 Founder & CEO - Khadi Essentials, Nov 2019 to Present Co-Founder & CEO - TAC - The Ayurveda Co, Jul 2021 - Present

Sales

Fiscal Year :2021-22(9Months): ₹12.7 Cr, EBITDA -20%(Loss) Apr-22 to Jan-23 : ₹38 Cr, EBITDA -26%(Loss) FY 2022-23 Projected - ₹45 Cr, EBITDA -26%(Loss)

Previous Investment and Equity Split Before Shark Tank

Last Round, Investment & Valuation

- March 2022 : Raised ₹12.7 Crores at Pre-Money Valuation of ₹81 Crores From Azim Premji’s Wipro

- Ongoing Convertible Round : ₹100 Cr

Offer Given by Sharks

*Aman's Offer - ₹50 Lakhs for 1% Equity & ₹1 Crore Debt @ 10% Interest at Valuation ₹50 Crores *Vikas's Offer - ₹75 Lakhs for 1% Equity & ₹75 Lakhs Debt @ 12% Interest at Valuation ₹75 Crores *Counter Offer - ₹75 Lakhs for 0.5% Equity & ₹75 Lakhs Debt @ 12% Interest at Valuation ₹150 Crores *Revised Counter Offer - ₹50 Lakhs for 0.5% Equity & 1cr Debt @ 12% Interest at Valuation ₹100 Crores *Final Offer by Both Sharks - ₹81 Lakhs for 1% Equity & ₹69 Lakhs Debt @ 12% Interest at Valuation ₹81 Crores *(Deal Accepted by the Entrepreneurs of TAC)

Original Ask ₹1.5 Crores for 0.5% Equity at Valuation ₹300 Crores

NAARA AABA

Shark Tank India Season 2 Episode 51 Pitch No. 3 : Naara Aaba is a Wine Manufacturing company which is established in Zero Valley, Arunachal Pradesh and they ask 75 Lakhs for 2.5% Equity lets see is the sharks are interested to invest in NAARA AABA.

Profile

Company - Lambu-Subu Food and Beverages Limited Launched In : 2017 Co-Founder : Takhe Tamo & Tage Rita Website : https://www.naaraaaba.com Industry - Wine and Alcohol Products - Manufacturing Capacity : 60,000 Ltr/Batch Gross Margin - 50% Net Margin - 18% - 19% ASK - ₹75 Lakhs for 2.5% Equity at Valuation ₹30 Crores

Ask by Naara AAba in Shark Tank India Season 2 Episode 51 ₹75 Lakhs for 2.5% Equity at Valuation ₹30 Crores

Sales

Lifetime Sales : 3 Lakhs Bottles in Three States Arunachal Pradesh, Assam, Meghalaya Average Monthly Sale : ₹45 Lakhs - ₹46 Lakhs Monthly Net Profit : ₹8Lakhs - ₹9Lakhs

Meaning of Naara Aaba Naara - Name of the Place Aaba - Father The name is Dedicated to her Father-in-Law

Background of Takhe Tamo & Tage Rita

Both the Co-Founders are Husband and Wife

Tage Rita : Tage Rita is an agricultural engineer from Ziro Valley and is India's first kiwi wine brewer. In 2018, she was honored with the Women Transforming India Awards, organized by the United Nations and NITI Aayog.

Products Information

Contents Of Alcohol Classic : 13% Sweet Variant : 10% Other Variants : 10% Variants Kiwi : 2 Plum : 2 Wild Apple : 1 Pear : 1

Cost Break Down Classic MRP - ₹1200 Selling Price - ₹800 Mfg. Cost - ₹400 EMI/Bottles - ₹78 Promoter - ₹50 Logistics - ₹60 Marketing & Manpower - ₹62 Profit - ₹150

Offer Given by Sharks

Vikas's Offer : ₹50 Lakhs for 5% Equity & ₹25 Lakhs Debt @12% Interest at Valuation - ₹10 Crores Vineeta & Vikas's Joinet Offer : ₹75 Lakhs for 10% Equity at Valuation ₹7.5 Cr No Debt Counter Offer : ₹75 Lakhs for 5% Equity at Valuation ₹15 Cr Vineeta & Vikas's Revised Offer : ₹75 Lakhs for 7.5% Equity at the Valuation ₹10 Cr. Counter Offer 2 : ₹50 Lakhs for 5% Equity & ₹25 Lakhs Debt @10% Interest, Valuation ₹10 Cr Deal Accepted by the Sharks and The Entrepreneurs

Original Ask ₹75 Lakhs for 2.5% Equity at Valuation ₹30 Crores

StyloBug

Profile

Co-Founders : Nidhi Gautam & Kamal Tripathi (Delhi) Launched : Nov 2018 Website : https://stylobug.com Nidhi Gautam - Chief Executive Officer Mass premium kids wear brand Fashionable & Affordable Price Range - ₹300 - ₹5000 Customers 10 lakhs

Pitch of Stylo in Shark Tank India Season 2

Kamal Tripathi : Sharks, Kids might be small in stature. But their clothes are more expensive than ours. Sharks, every parent wants their children to wear cute and stylish dresses. But the problem is that it doesn’t fit them after 3-4 months.

Nidhi Gautam : Sharks, this problem is close to my heart. When I used to go to the market to shop for my daughter, all the trendy and fashionable dresses were very expensive. That’s when I realised that it’s not my problem alone. It’s the problem of many middle-class mothers like me. To solve this problem, we launched StyloBug, kids wear brand.

Available Across

Online : Own Website & Amazon Flipkart Etc.

Offline : 10+ Multi Brand Stores

Costomers : ₹10 Lakhs+ Customer Connected with this CompanyAsk By StyloBug in Shark Tank India Season 2 ₹80 Lakhs for 2% Equity, Valuation - ₹40 Crores

Background of Nidhi Gautam & Kamal Tripathi

Both the Co-Founders are Husband and wife

Kamal Tripathi Education - High school - St. John School B. Tech Mechanical Engineering from IIT-Delhi in 2004 Working Experience Software Engineer - Infosys Technologies Ltd, Aug-2004 to Apr 2007 Senior Software Engineer - Qwest Communications, May 2007 to Apr 2009 Project Dev. Leader - Qwest Communications, Apr 2009 to Apr 2011 Module Leader - CenturyLink, May 2001 to Nov 2011 Senior Engineering Manager - Snapdeal , Nov 2011 to Mar 2015 Director of Engineering for Mobile - Snapdeal , Apr 2015 to Apr 2016 Technology Mentor - Various Vice President of Engineering - Fliplearn Education Pvt. Ltd. Apr 2016 to May 2018 VP of Engineering - Zomato, Jun 2018 - Jul 2019 Investor cum Advisor - Stylobug Enterprises, Oct 2016 - Oct 2020 SDM-III - Amazon Full-time , Sep 2019 - Jun 2021 Advisor - Eleventyfirst Parallel Technologies, Sep 2021 - Present Co-Founder - Stylobug Enterprises Full-time Jul 2021 - Present

Nidhi Gautam Education : BBA in Marketing from RDVV MBA from Indira Institute of Management Working Experience Pre Sales Lead - Next Education India Pvt Ltd, Sep 2009 - Sep 2010 Territory Sales Manager - S.Chand Harcourt (India) Pvt. Ltd., Sep 2010 - Aug 2011 Associate Sales Consultant - NIIT Limited, Nov 2011 - Mar 2013 Founder/CEO - StyloBug (KidsWear), Oct 2016 to Jun 2022 Chief Executive Officer - StyloBug (KidsWear), Sep 2016 - Present

Key Factors in StyloBug

Mass premium kids wear brand

Fashionable & Affordable

Price Range - ₹300 - ₹5000

Customers 10 lakhs

In-house designing & Manufacturing

Inventory Holding Period - 2 months to 3 months

Marketing Spend - 4% -5% of Net Sales

5% from D2C BusinessFirst Principles Thinking : It is a means to challenge assumptions and solve complex problems by breaking them down into their most basic elements and reassembling them from the ground up. Dead Stock : It is the inventory that remains unsold for a prolonged period. Proprietary Enterprise Resource Planning (ERP) solution MOQ - Minimum Order Quantity Backward Integration - It refers to the integration of a company with its suppliers and supply side to reduce the cost of goods and services and incorporate innovations.

Sales

Annual Sale FY 21-22 : ₹14 Cr FY 22-23 Proj. : ₹14 Cr Monthly Sale Jan-23 : ₹46 Lakhs Dec-22 : ₹42 Lakhs Nov-22 : ₹50 Lakhs Monthly Growth Rate -16.0%

Margins Split COGS : 45.0% Trade Margins, Logistics & Marketing : 30.0% Rent & Electricity : 5.0% Employee Cost : 1.0% Remaining Exp. : 1.0% Net Margin : 18.0%

Offer Given by Sharks

Amit's Offer - ₹80 Lakhs for 10% Equity at Valuation - ₹8 Crores

Counter Offer - ₹80 Lakhs for 5.71% Equity at Valuation - ₹14 Crores

Amit Jain not Negotiated with Counter offer he stand with their previous offer.

Deal Accepted by the Entrepreneurs

Original Ask ₹80 Lakhs for 2% Equity, Valuation - ₹40 Crores